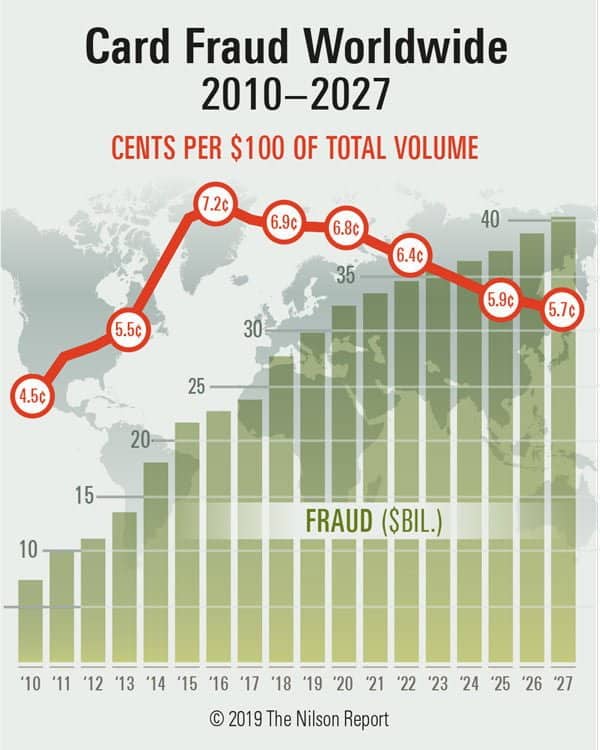

According to the Federal Reserve Payments Study, Americans spend an average of $44.7 billion through credit cards. The rise in credit card usage has had an unintended side effect. Credit card fraud is also on the rise as global fraud losses have reached $27.85 billion in 2018, and it is projected to rise to $35.67 billion by 2023, as per the Nilson report.

Table of Contents

Toggle

Types of Credit Card Fraud

Listed here are a few types of broadly classified credit card frauds.

Stolen credit card:In this type of scam, the thieves steal the credit card and make fraudulent transactions before the customer knows about it.

Card-not-present fraud: Using the customers’ credentials, hackers take over the client’s credit card account and make purchases online. There is no involvement of the physical credit card here.

Counterfeit Cards:Scamsters used skimming machines to make duplicate cards. Thankfully with the advent of EMV technology, this type of fraud has reduced.

Intercepting Mailed Cards:Customers have reported about their credit cards being stolen from their mailboxes.

Identity theft:Using forged documents, scamster apply for a credit card on behalf of the user and make fraudulent transactions.

Technical solutions to prevent credit card fraud

Although there are many technological challenges in credit card fraud, government agencies and credit card companies are coming together to avert credit card fraud. Here are a few technical tools that aid in preventing credit card fraud.

Card lock

Many credit card companies provide the card lock facility to their users, which allows them to “turn off” their credit card, making it a useless piece of plastic. The card lock service comes in handy in case of a lost or stolen credit card.

The users need to activate the card lock feature using a mobile app or their net banking account.

Discover was the credit card company that brought the idea of card lock to the market; they called it the “Freeze it” feature. Today many card companies like the Bank of America, Barclays,

Citi, Wells Fargo, and American Express offer the service.

CVV and AVS verification

The CVV code is the short 3 digit security code often found on the credit card’s backside. The CVV acts as an additional security layer for hackers difficult to crack; it is easy to steal just the credit card number rather than stealing both the CVV number and the credit card number.

AVS (Address Verification Service) is a fraud prevention system introduced by Mastercard to stop CNP (Card Not Present) frauds. Under AVS, the user enters the address while conducting an online transaction. The system then verifies the entered address with the address mentioned in the bank records of the customer. After comparison, the bank issues an AVS code to the payment system, based on which the next action is taken.

Both AVS and CVV are an essential part of a multilayered fraud protection mechanism.

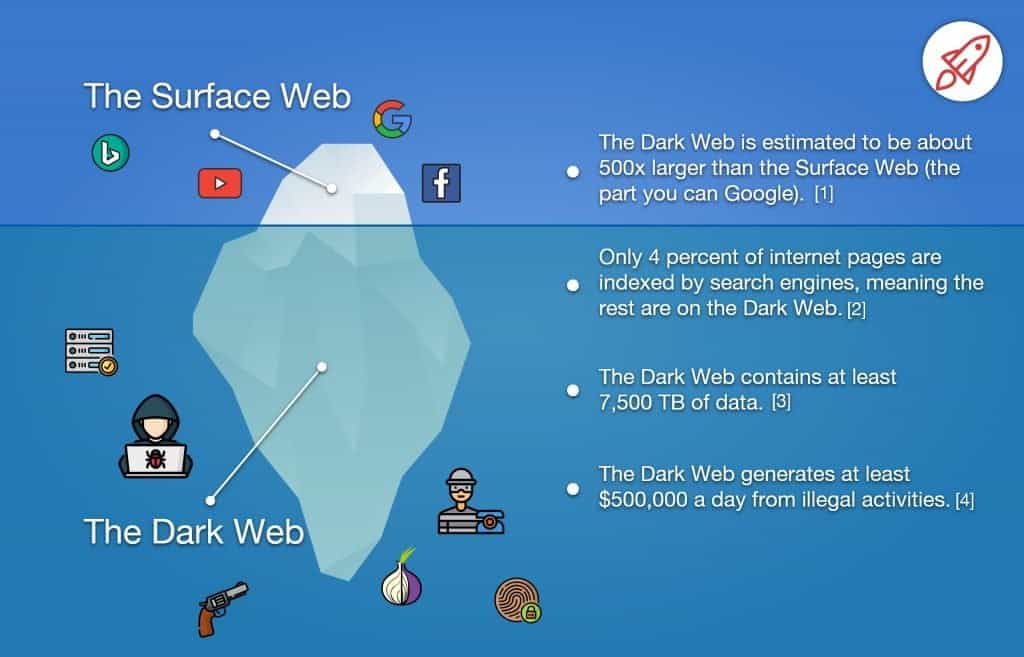

Dark web monitoring

The dark web consists of websites that are not indexed by search engines like Google and Bing. It is estimated that the dark web is around 500 times bigger than the surface web. The websites are out of the public eye and are not visited by most of the internet users. This is where internet criminals like credit card hackers sell the stolen information as it is impossible to know the source of upload.

Virtual credit card numbers

Virtual credit cards are powerful tools that help in curbing cybercrime in credit card. Virtual credit card numbers are the numbers that are linked with the real credit card. Both the numbers are different, and the idea behind providing a virtual credit card is that the actual credit card information won’t be compromised even if the virtual number is stolen.

These virtual credit cards are complete with every piece of information like the expiration date and CVV number that a real card possesses. These cards act as a mask for the actual credit card number and are used primarily for online shopping.

The virtual cards can be used even for a single transaction, and companies like Eno are offering alerts related to suspicious transactions even on virtual cards.

The four credit card majors Visa, Discover, American Express, and MasterCard, have joined hands to provide a virtual card service called “Click to Pay.”

Fraud scoring with Machine Learning

Fraud scoring is a mechanism that uses technologies like Machine Learning to identify the likelihood of fraud. There are many AI-driven ways to analyze the possibility of credit card fraud.

The machine learning algorithms continuously scan for a financial activity that deviates from the customer’s normal behavior. The fraud scoring system automatically alerts the bank officials and the customer whenever it detects a scam’s early signs.

Machine Learning systems are better in catching any fraud because they adjust themselves if the scamsters change their modus operandi. The adaptability of Machine Learning systems protects the user against online scams in credit cards.

Contactless cards and digital wallets

The NFC (Near Field Communication) technology allows credit card companies to offer contactless payment systems. The contactless methods are an effective tool against online banking fraud since they use a security system called “tokenization,” which completes the transaction without sharing the merchant’s actual credit card information. The contactless credit cards have an RFID chip inside them, which transmits the information required to the payment terminal.

Systems like Apple pay are using NFC for enabling their payment transactions. The users get an additional security layer with smartphones as they are locked with face scan or patterns.

The mobile wallets as a mode of transaction is something that everyone would have heard about as one of the most used mode during the ongoing pandemic. However, there are many ways through which fraudsters can take benefit of mobile or digital wallet systems for stealing card information or directly the money from the other account. The biggest weak point present in the digital wallet ecosystem is enrolling the credit or debit card. If somebody manages to have physical access cards or any information–maybe fetched through data breach–they may get a way to register that card on their own digital wallet, even if the names on the cards are different. Experts say that it is easy to bypass the authentication check on various platforms though the names don’t match with the registered IDs which is an example of digital wallet fraud.

Credit monitoring

Almost all credit card companies offer free credit monitoring services to protect users from identity theft.

The alternative to credit monitoring services is that the users should themselves check their credit card records regularly. Most credit card companies offer websites and apps from which the users can monitor their transactions.

The users can also avail of various paid credit monitoring services like privacy guard, identity guard, and Experian IdentityWorks for extra security.

Limiting websites that save credit card information

Many websites ask the user to store their credit card information on their websites. While the websites may claim that they have robust security systems, users need to understand that no security system is 100% foolproof and can lead to online fraud. The best possible way to avoid hackers stealing credit card data from such websites is to avoid saving the websites’ information.

Users can use payment services like PayPal, Google Pay, or Apple Pay, which are safer alternatives if they find entering the credit card information every time they transact a cumbersome process.

Sign up for alerts

Simple safeguards like signing up for email and phone alerts can safeguard the users against fraud. All the credit card companies have this feature auto-enabled, and they send the users alerts whenever a financial transaction is done by the card. If the users find out that they did not initiate the transaction, they can immediately report. Immediate reporting allows the authorities to stop the trade, saving the lengthy procedures for claiming the money back afterward.

Geolocation

Visa mobile location confirmation is a service that allows the systems of Visa to access the location of the credit card user using their smartphones. This ensures that the user is physically present at the site where the transaction is taking place. Credit cards’ geolocation feature eliminates scams where scamsters access credit card information and conduct transactions from the user’s credit card online, generally from elsewhere. By pinpointing the user’s location, credit card companies are adding another layer to credit card security.

Velocity limits

The CNP (Card Not Present) fraudsters like to test the stolen credit card data. They see whether they can cheat the systems into accepting one fraudulent transaction, and when the system does allow it, they quickly max out the credit card before anyone notices.

An effective way to protect credit card users against such types of fraud is to provide velocity checks. The velocity check monitors certain critical data elements that aid the credit card fraud prevention systems identifying fraud. The primary purpose of velocity check systems is to help the merchants review repeated patterns within a short time.

The velocity systems can alert the concerned authorities when the data is entered multiple times within a short time.

The following are the data elements that a velocity check system typically monitors

● User ID

● Billing address

● Phone number

● IP address

● Device ID

● Credit card number

● Email address

● Shipping address

Summing up

How to prevent fraudulent transactions in credit cards is a common question plaguing the credit card user today. The credit card brings convenience and security to the users, but the same can become a cause of agony if the user is a victim of any credit card fraud. Smart systems are coming to the aid of credit card users and empowering them against cybercriminals. Using fraud detection tools and following some simple precautions, the users can protect themselves against credit card fraud.