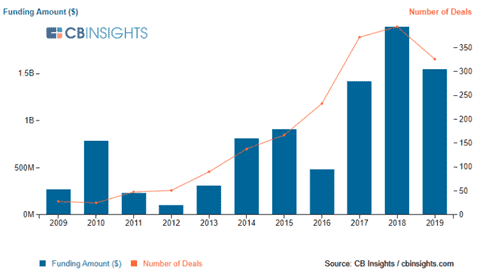

The legal tech startup market is booming and has attracted a lot of interest from investors. In 2018, the legal tech industry had set an investment record, growing at a rate of 713%, with LegalZoom securing $500 million from investors led by Francisco Partners and GPI Capital. The biggest news of 2019 was a law practice management company, Clio, securing $250 million in Series D funding from TCV and JMO Equity, two major growth equity firms. That year saw investments in the industry total close to $1.5 billion. And, just before COVID-19 ravaged the markets in early 2020, 15 tech startups had already secured $1.4 billion in venture capital funding.

Table of Contents

Toggle

(Image source: American Bar Association)

The irony is that COVID-19 will accelerate the trend towards tech as more law firms explore remote working models and legal tech startups continue to develop e-lawyer solutions.

The true size of this market is difficult to ascertain. Existing data is limited and mainly anecdotal. However, AngelList’s listing of legal startups provides a good guesstimate of the growth of this industry. In 2009, only 15 firms were listed in this category on AngelList. By 2015, this number had grown to over 700. As of December 2020, there were over 1,400 legal tech startups on AngelList.

Deloitte and PwC have recently launched legal tech incubators to help early-stage legal tech companies access their consulting, technology, legal, and investment expertise. Deloitte’s legal tech incubator program, Deloitte Legal Ventures, will leverage the startups’ products and services.

Defining a Legal Tech Startup?

But what exactly is a legal startup? Is it a law firm that delivers legal services exclusively via technology, or is it a non-legal firm that solely creates and sells legaltech products to the legal industry?

The answer is more nuanced. A legal tech startup is a new firm, division, or offshoot of an existing firm that uses technology to create innovative products and services that improve legal service delivery. From this definition, it’s clear that a legal tech startup may or may not be a law firm. The answer lies in whether the firm offers product and service innovations to improve legal service delivery.

What Drives Interest in Legal Tech Startups?

Legal tech companies aren’t a new phenomenon. They have been around since the nascent days of the Internet. But, it is only in the last decade or so when they have attracted investor interest.

No single driver can be attributed to the emergence of legal tech companies. Several factors have contributed to this development. Let’s consider some of them below.

Demand Side

On the demand side, we have three major factors:

- Lucrative Industry: The global legal services industry is expected to be worth $1 trillion by 2021, with the US accounting for half this figure. Furthermore, large law firm profits have shot up massively in recent years. According to The 2020 Am Law 100 Report, the profits per equity partner of 50 of the biggest law firms in the US averaged $ 3,087,880 in 2020. This is big business, and everyone wants a piece of the action.

- Unmet Need for Legal Services: There is a huge unmet need for legal services from people and businesses who can’t afford legal services and those who don’t know that they have a legal problem. According to a survey by the World Justice Project, only 38% of people surveyed in the US could access professional legal advice for a legal issue. This is despite the US having one of the highest numbers of lawyers per capita in the world. This gap has fueled the growth of legal tech startups.

- Client Demands: Following the 2008 world economic recession, there was pressure on company boards to cut spending. One of the areas targeted for cuts was legal fees. Companies are now hiring more in-house lawyers and only bringing in outside counsel when necessary. Clients are also demanding greater transparency in legal billing hours and other aspects. This trend has created a space for legal startups to capture work that has been insourced.

Supply Side

There are also three major factors on the supply side.

- The Industry’s Failure to Meet Legal Needs: The unmet need for legal services on the demand side has created a competitive landscape for law firms. Competitors not only include other law firms but a multitude of other players as well. This scenario has forced them to abandon their traditional conservative attitudes and embrace innovation to improve service delivery.

- The emergence of a Legal Startup Ecosystem: As mentioned earlier, there were only a handful of legal startups in 2009. Today numerous new firms are competing for a piece of the pie due to investment flows into this industry. Increased funding opportunities have made it easier for innovators to launch companies. Additionally, many jurisdictions worldwide have relaxed rules on who can provide and share in legal revenue. For example, a few years ago, the UK introduced Alternative Business Structures (ABS), a concept that allows non-lawyers to participate and share a law firm’s profits. There is a similar initiative in Australia. Although the same is yet to happen in the US, it’s just a matter of time for pressure to emanate from other jurisdictions. The quality of technology has also improved markedly, and the costs have fallen significantly, eliminating a major barrier to entry.

- Labor Mobility of Legal Professionals: Before legal technology firms and non-traditional legal careers emerged, a law school graduate’s only career option was to join a law firm. Today, there are many different career permutations. Law schools now highlight these options and encourage students to become legal service delivery entrepreneurs.

Types of Services Offered by Legal Tech Start-Ups

The best way to understand the types of services offered by startup legaltech firms is to examine the three operating models.

Model 1: Focus on People

Early legal startups focused on saving on labor costs by replacing expensive labor in the legal supply services chain. Legal Process Outsourcing (LPO) companies work on this model. Legal services are outsourced to jurisdictions where labor is cheaper, often across international borders. Clients are provided with a portal where they can post legal work complete with instructions. A lawyer in another jurisdiction takes up the work, works on the job while giving updates in the portal, and collaborates with the assignor where necessary.

Model 2: Focus on Processes

The disaggregation of services in the legal supply chain has created immense opportunities for new firms. Traditionally, one lawyer or team of lawyers would take up the entire legal matter and provide a complete solution. Today, a legal issue is often chopped up into tasks and the tasks allocated to various people and firms with the best specialization to work on the task. Generalists are fewer, and individual lawyers now focus on solving specific legal issues. Disaggregation has made possible process definition, standardization, and systematization, which has created the opportunity for legal tech startups to provide commoditized solutions while remaining within the confines of the restrictions to delivering legal services.

Model 3: Focus on Technology

Lawyers and law firms have historically had more access to legal information that their clients. This meant that clients had to consult lawyers for even the simplest of issues. With the deep Internet penetration in most parts of the world, people can conduct preliminary legal research on their own before walking into a lawyer’s office. The Internet has also made it possible for many people to represent themselves and save a pile of money in the process. Legal services have also been unbundled as clients seek to have lawyers only handle a portion of their cases while they handle the rest. Technology has replaced a growing number of tasks that were previously done manually. For example, technology-assisted reviews now help lawyers and clients conduct due diligence inquiries and litigation reviews faster, while e-discovery solutions have reduced the time it takes to find and collate evidence as well as to conduct litigation research.

Legal Tech Start ups Market Segments

The following are examples of market segments served by legal tech startups.

Business to Consumer (B2C)

This market segment includes business transacted directly by the legal tech startup with the consumer as the end-user. Examples of services provided by B2C firms in this space are commoditized services such as document drafting platforms for simple contracts, divorce documents, and wills. This segment also includes small businesses as end-users because they consume legal services in the same manner as individuals. Examples of some of the services offered include:

- Find a Lawyer

- Lawyer Marketplace and Ratings

- Lawyer Screening and Matching

- Do It Yourself

- Tiny Law

- Form Documents

- Document Automation (Assembly)

- Free Legal

- Online Legal Aid

- Dispute Avoidance and Management

- Collaborative Law

- Litigation Finance

Business to Business (B2B)

In this market segment, legal tech startup firms sell their services directly to other companies. For example, a company looking to acquire another company may purchase technology-assisted review solutions from a legal tech startup to conduct the due diligence faster and save on some legal bills. This segment does not include law firms and corporate legal departments. Examples of some of the services offered include:

- Find a Lawyer

- Lawyer Marketplace and Ratings

- Lawyer Screening and Matching

- Assessing Lawyer Quality

- Managing the Legal Supply Chain

- Billing Data Analysis

- Legal Temp Services and Contract Lawyers

- Legal Process Outsourcing (LPO)

- Dispute Avoidance and Asset Management

- Compliance

- Contract Management

- Risk Management

Business to Government

The best example of this market segment are courts that purchase the same solutions that law firms and businesses purchase. An examples of some of the services offered is Online Dispute Resolution.

Business to Lawyer

The final market segment comprises startups that sell legal tech solutions to lawyers, law firms, and corporate legal departments. This segment is by far the largest. Examples of some of the services offered include:

- Lawyer-to-Lawyer Networking and Referrals

- Marketing

- Traditional Legal Research

- Crowdsourcing

- Analytics

- Legal Education and Training

- Practice Management and Back Office

- Client Intake and Conflicts

- Time and Billing

- Virtual Legal Team Tools

- Lawyer Recruiting

- Project Management

- Knowledge Management

- Document Automation (Assembly)

- Docket Management

- Outcome Analytics

- e-Discovery Solutions

- Vendor Marketplaces

- Trial Tools

- Transactional Tools

The legal industry has been ripe for disruption for many years. There is no question that legal tech startups are disrupting the legal industry. What remains to be seen is whether this is just mere hype that will lead to a spectacular crash or the new normal. Only time will tell.